China Water Park Market Outlook

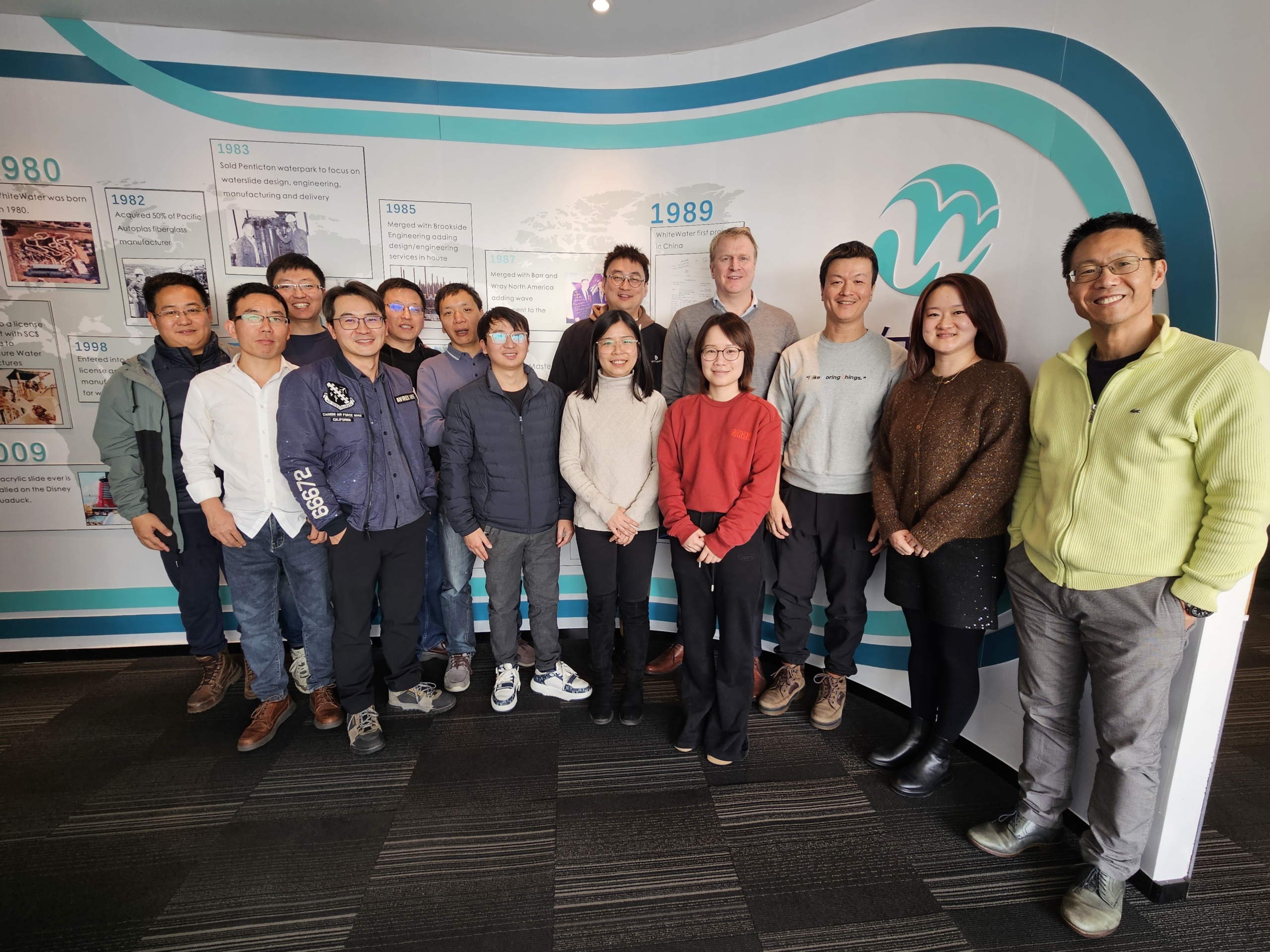

As we wrap up the 15 days of Spring Festival celebrations in the Year of the Dragon, let’s take a look at what’s in store for the Chinese water park market. With WhiteWater having a strong foothold in this country for almost 15 years, we asked some of our experienced China team members to share their insights and predictions for the coming year.

A Better Year for a More Mature Market

As the world’s second-most populous country with the second-largest economy, domestic tourism in China will always be a strong economic driver. Phil Zhong, WhiteWater’s Director of Engineering and Asia COO, pointed out that China continues to have one of the largest middle classes globally, which equates to a substantial consumer base for short getaways and summer holidays. There will be plenty of opportunities for projects that understand their target audiences and possess a solid business model, though these might manifest differently than in the past.

Over the past decade, WhiteWater has completed nearly 100 projects in 20 provinces across China, witnessing the rapid development of the attractions industry in this country. The team believes that the water park industry in China is maturing. “In the past few years, most domestic water park projects were related to real estate development. In other words, the progress of real estate projects drove the development of water park projects,” said Phil. “Now, we can see significant changes in the Chinese real estate sector. Meanwhile Chinese water parks have accumulated a lot of experience. Just like the dot com bubble over a decade ago, after the frenzy of technology, many tech companies without a solid foundation disappeared, but there were also many excellent tech companies that survived and thrived following the burst.”

Higher Demand for High-Quality Experiences

Compared to the pre-COVID era, the development of location-based entertainment (LBE) projects in China has slowed down, but there is an increasing focus on quality in the market,” said Dawn Tong, Senior VP, Business Development—Greater China. This trend is not coincidental. With the development of the Chinese economy, an increasing number of Chinese tourists recognize and pursue high-quality amusement experiences, placing greater emphasis on safety. The market’s pursuit for quality is evident across the pre-opening, post-opening, and expansion stages.

Planning Phase

Late last year, Meryal Waterpark opened in Qatar with the extraordinary 85-meter Icon Tower being the talk of the industry. In Taizhou, China, construction is underway for M100 Waterpark, a water slide tower that will reach a record-breaking 100 meters upon completion in summer of 2025.

Also planned in the same time frame is LEGOLAND® Shanghai, which is rapidly under construction.

“We have been involved in many large-scale, uniquely challenging projects, including high-profile IP projects in development,” shared Dawn. “With renowned IP parks taking root in China, some local governments are actively seeking opportunities for the development of world-class attractions to compete with Universal Studios Beijing and Shanghai Disney Resort.”

Lavender Zhang, VP, Business Development—Greater China, agreed and added that sustainability is also becoming a focus. “We have received more requests regarding water resource management and smart, energy-efficient attractions. I am pleased that WhiteWater is one of the industry leaders in sustainable development, so we are confident and able to provide solutions for our clients. Increasingly, Chinese owners are realizing that more sustainable equipment leads to lower maintenance costs and contributes to a healthier corporate reputation.”

Building Phase

“The maturity of the market is also reflected in the increasing attention developers are giving to service quality and engineering standards,” said Project Director David Fang. “Whether it is a large and unique project or one that requires integration with existing facilities, projects these days have higher demands and challenges for engineering design and implementation.”

With the TSG 71-2023 “Technical Regulations for Safety of Large Amusement Facilities” going into effect on March 1st, the management of large amusement facilities will become more standardized, with higher requirements for quality and safety, which naturally raises the standards for equipment manufacturers.

Expansion Phase

Existing water parks, in order to maintain their market competitiveness, are also increasing their investment in quality. “Many parks are planning to upgrade or refurbish equipment to enhance quality and safety to attract new visitors and repeat customers,” said Performance Services Manager Laguna Xu. Take Studio City Water Park in Macau, for example. After the first operating season, the park decided to introduce Life Floor, a foam rubber aquatic flooring system, to enhance the experience and safety of visitors. With good guest feedback, Studio City decided to use Life Floor in its second-phase indoor water park expansion.

Go Straight to the People Who Know the Equipment Best: OEM

Parks that prioritize quality and maintenance have been proven to have longer equipment lifespans and a healthier return on investment (ROI). In recent years, many of WhiteWater’s clients have celebrated tenth anniversaries.

In customer follow-up interviews, they have found that investing in quality attractions was a wise decision. Chen Gengqing, the General Manager of Adventure Island Water World in Lishui, shared with WhiteWater on their 10th anniversary: “When we initially chose a partner, WhiteWater impressed us with its high-quality products. The overwhelmingly positive feedback from visitors also proves that our choice back then was the right one.”

According to Laguna, more and more clients are now considering, months before season opening, to allocate more resources to equipment maintenance, parts replacement, refurbishment, and even new theming. This is to ensure that the attractions not only continue to run safely but also look good.

Laguna is pleased with this shift in how the domestic operators approach maintenance, as working with original equipment manufacturers and certified third-parties for inspections and refurbishments is an effective way to assess risks and improve operational efficiency.

New Market Segments, Huge Potentials

Skiing x Water Fun

“We see a trend of combining water parks with diverse sports,” said Lavender. “Some forward-thinkers have already built water parks in ski resorts, creating complementary amusement experiences and extending the operating season.”

After the Beijing Winter Olympics, ice and snow tourism transformed from being “cold resources” to a “hot economy,” and the idea has been heading south. According to the China Ice and Snow Industry Development Research Report (2023), the scale of China’s winter sports industry should reach 890 billion yuan in 2023 and exceed 1 trillion yuan in 2025, accounting for an estimated one-fifth of the total output value of the Chinese sports industry.”

In Shanghai, the construction of SnowStar, the world’s largest indoor ski facility, is entering its final stages. This project, with a total floor area of 350,000 square meters, not only includes an indoor skiing hall with an area of about 90,000 square meters but also features an all-weather indoor and outdoor water park, a hotel, a multi-functional exhibition center, and an ice and snow-themed commercial area. Upon completion, it will become an all-in-one winter-themed holiday destination.

Surf Parks

Lavender also shared that some domestically renowned developers with strong business acumen are actively catching up with the global surf trend. They are integrating water parks into surf parks and developing additional facilities around them. This not only caters to surf enthusiasts but also helps to attract a broader audience, including families.

Undoubtedly, while this type of business model is still developing, its high level of specialization means it is in a “high demand, low supply” stage in 2024. “This validates our strategic direction,” said Lavender. “Taking the Endless Surf surf lagoon as an example. We are no longer just focused on how to attract 3,000 to 5,000 visitors daily. We are, at the same time, considering how to help clients meet the needs of a high-spending group of 100 – 200 visitors each day and encourage them to visit repeatedly.”

Hotels and Resorts

Scott Haycock, Senior Vice President, Business Development—Greater China, observes: “On a global scale, an increasing number of hotels and resorts are standing out by adding aquatic amenities. In China, this trend is also evident.”

According to the “Global Analysis of the Impact of Water Park Equipment on Hotels and Resorts” published by Hotel & Leisure Advisors, the average daily rate (ADR) of hotels increased after the addition of water park amenities.

Let’s go back to Studio City in Macau as an example, where the hospitality industry is highly competitive. This resort has the only large water park in town, featuring both outdoor and indoor sections. It has won several international awards since opening in 2021. The year-round operation of the water park not only brings unique competitiveness to Studio City but also extends guests’ stay and increases other spending. It enhances Macau’s vibrant leisure and entertainment experience, taking the city beyond the gaming economy.

Don’t Overlook the Kids; Families Remain the Target Audience

“After the pandemic, we have seen the recovery of the tourism industry in China, and this growth is good news for many. I also see tremendous opportunities for family entertainment,” said Scott. “As a father, I know that children basically determine whether a family will visit a certain attraction and how long they will stay. However, in the past, when developers set their target customers, children, as a demographic, often did not receive the attention they deserve.” In recent years, water parks worldwide have been reimagining and investing in kids’ areas. With so much technology in our daily lives, haphazardly designed children’s play areas will quickly become boring for the youngsters, leading frustrated parents to look for other ways to entertain their children and spend their money elsewhere.

Many parks design separate areas for children, teenagers, and adults. However, in reality, families do not always play this way. We believe that people often look for places where the whole family can engage with each other. Additionally, parents want to be able to take a break while their children play nearby. This means that plenty of seating, cabanas, easy access to food and beverage, as well as restrooms should be in very close proximity to the kids’ area.

It’s a lot to take in, with the Chinese market holding so much potential. We wish you a good start to the Year of the Dragon. Feel free to reach out to us at whitewater@whitewaterwest.comto discuss new project ideas or ways to make your existing equipment work like new.